Governance as a motor for sustainable growth

Many governance coins lack real Onchain power on protocols and capital flows. Even when a protocol produces value, it usually does not accrue the coin and leaves little reason to engage the owners.

If you are building a protocol, you’ve probably seen it first – the government becomes political and inference and community participation disappears.

But this doesn’t have to be like this. By connecting governance, incentives and value accruals, you can create a system that supports long -term growth and sustainability.

Governance and tokenomic work together – the design of your coin affects the governance dynamics, while governance decisions determine how resources are allocated, how the value is created, and in the end the marker accrues.

Protocols, which placed economic incentives, see more powerful ecosystems where coin holders actively contribute, because they directly benefit from participation through prizes, impact or income sharing.

Liquidity is required for your protocol. Economic activity fueled, attracts developers and improves user experience. However, only liquidity is not enough – the protocol and the coin should be effectively guided to enlarge the economy.

Governance should play a role in the withdrawal and retention of liquidity and help to ripen up to a stage in which your protocol can open income mechanisms. Once the wage key is activated, the governance can use the same infrastructure to direct income flows and convert management into a growth flywheel.

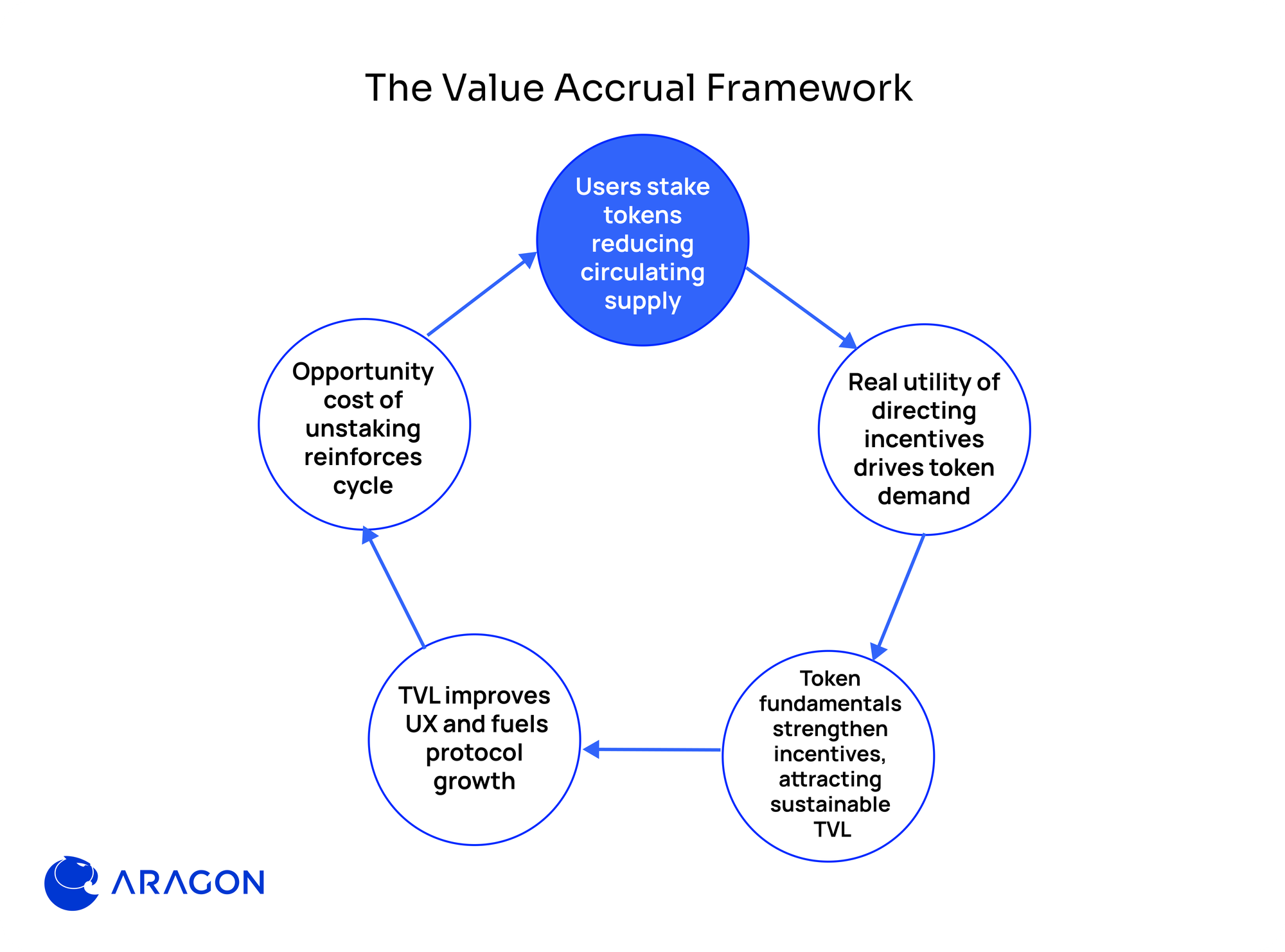

In order to help the protocols create positive feedback cycles between governance and value accrual, we have developed the governance primitives that strengthen the value tahakkâr to the governance coin.

How to work

- The coin holders ruin their domestic coin to access governance rights by reducing circulating supply and sales pressure.

- It controls governance emissions and incentives, creates concrete coin benefit, and attracts new demand from protocols that want to direct incentives.

- Developed token foundations lead to more predictable incentives by attracting sustainable TVL.

- Sustainable TVL improves user experience and strengthens the growth of protocol, further strengthening the foundation of the coin.

- As growth is balanced, the increase in the increase, the increase is outside the circulation.

In the best scenario, well -designed governance transforms incenomics to incentive harmony into sustainable growth. These flywheel guides both network growth and value accruals and make governance coins an integral part of long -term success.

Defection management has been repeated for years. Based on these best practices, we created the first tokenomic governance primitives on Aragon OSX to help the protocols design sustainable incentive structures.

Voting Lock (VL) Governance: A modular contract library that enables customizable voting cabinets that allow the protocols to make fine -tuning for governance and economic incentives.

Indicators Management: A governance add -on that allows the token owners to simplify decisions and clarify the compromises at the specified intervals of the voting power of voting power. Cleans a applicable path to optimize and automate the distribution of emissions, incentives and protocol income.

These primitives can be used separately or in a combination to create governance models that strengthen growth and value domination. Advantages include:

- Rewarding long -term participation and deterrence payment of mercenary behavior;

- To return the power to those who have real economic shares;

- To encourage deeper voter participation and community participation;

- Managing coin supply dynamics to support protocol health;

- To provide concrete governance services to token owners by providing control over financial flows since the first day.

Governance is not only about voting, but also to design economic systems that maintain participation, align the incentives and direct the real value to coin holders.

With the right mechanism design, you can go beyond governance as a passive obligation and turn it into a vehicle for protocol growth.

In order to learn more about our services, we work with projects such as Mode and Puffer to create governance models that support liquidity, network growth and value accruals.